Peak sales season benchmarks for retailers

Understand the most important digital KPIs—and how to leverage the learnings to nail your peak season strategy.

The busiest time of the busiest season was Black Friday weekend 2023 (November 24 to November 27, 2023), when traffic increased by +32.7% and conversion rate by +47.9%, compared to the weekend before.

To understand how consumer activity and behavior change during the holiday shopping season, Contentsquare analyzed over +31 billion page views and 6.7 billion site visits across 1,673 websites from 11 countries from November 1 to January 10. By analyzing the 2023 peak season, we can better understand shopping behaviors and what trends are shaping the retail sector this year.

Peak sales season benchmarks for retailers Understand the most important digital KPIs—and how to leverage the learnings to nail your peak season strategy.

So without further do, here are the five top CX holiday shopping trends you should know ahead of peak season 2024.

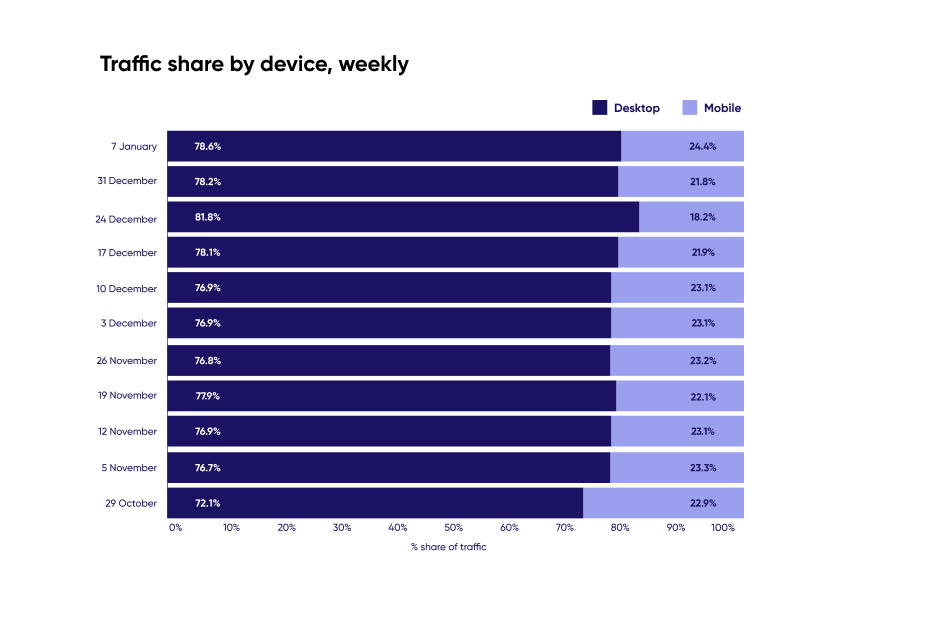

Visitors prefer to browse and hunt peak season discounts on smaller devices.

In 2023, mobile had the highest share of traffic during the two big peak event weeks: Black Friday and Christmas.

Despite mobile bringing in the most traffic, it converts at a lower rate than desktop. The average conversion rate on mobile during Black Friday weekend 2023 was 3.1%, while desktop saw 5.5% CRV—that’s almost a 60% difference in CRV in just a week.

To combat this discrepancy in device traffic and conversion, retailers should focus on optimizing their mobile checkout experience and provide quick payment options like Apple Pay or Google Pay ahead of Black Friday and Cyber Monday.

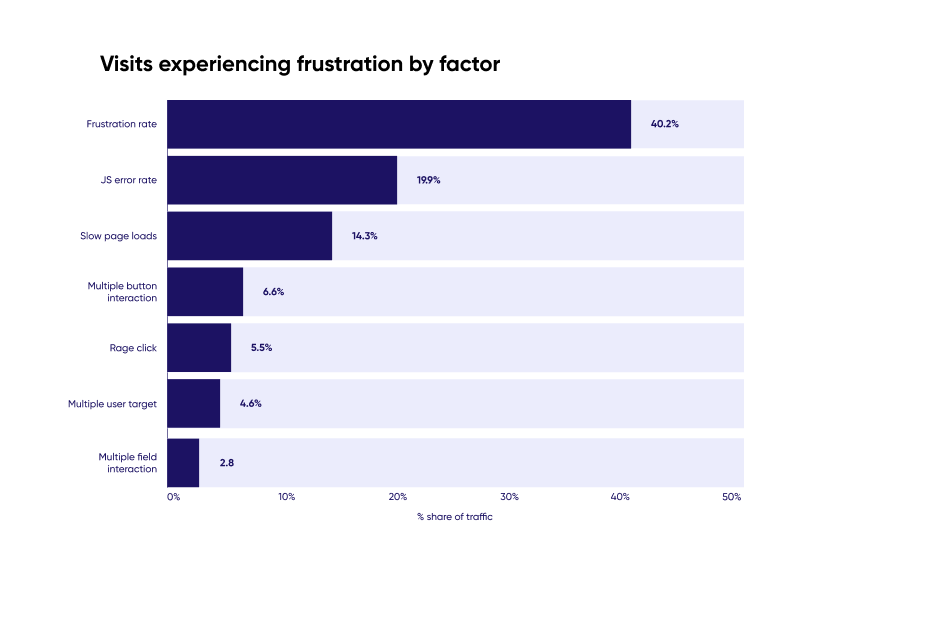

While increased conversions are a positive outcome of the holiday season, the surge in traffic and orders can cause issues that frustrate and foster customer dissatisfaction.

Frustration impacted more than 2 in 5 retail sessions during peak season in 2023. And the most frequently occurring frustration factors were JavaScript errors and slow page loads.

To fight this, retailers must find and fix any points of friction as quickly as possible. Here are just a few ways retailers can reduce page load speed:

There’s no better time to engage your visitors and ensure their buyer journey is seamless than during the busiest holiday sales period of the year.

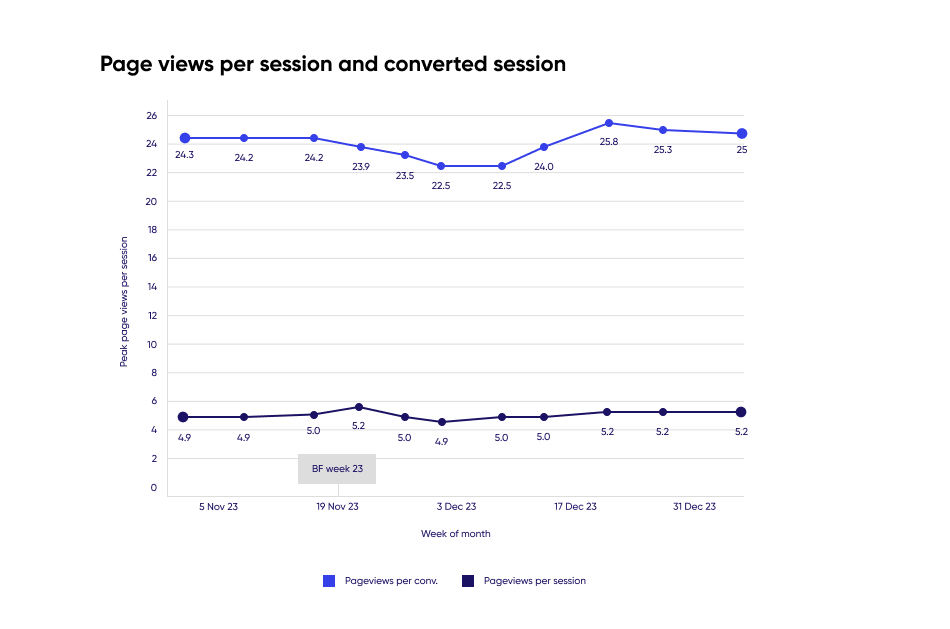

In 2023, holiday shoppers’ buying journeys were long, stretching beyond 25 pages, while mobile visitors viewed far fewer pages than desktop. And what’s more, global sessions with a conversion view up to 5X more pages than those that don’t.

Shoppers are clearly happy to browse more pages of the site to ensure they get the best peak season deal before committing to buy.

Ahead of peak season, retailers can speed up the buyer journey by adding promotion and online sales categories to their site’s navigation, making it easier for visitors to find what they’re looking for.

Or, like Lovehoney, try moving your main holiday shopping categories out of the filters dropdown and onto your promotional landing pages. Find out how they increased on-page conversion by +30%.

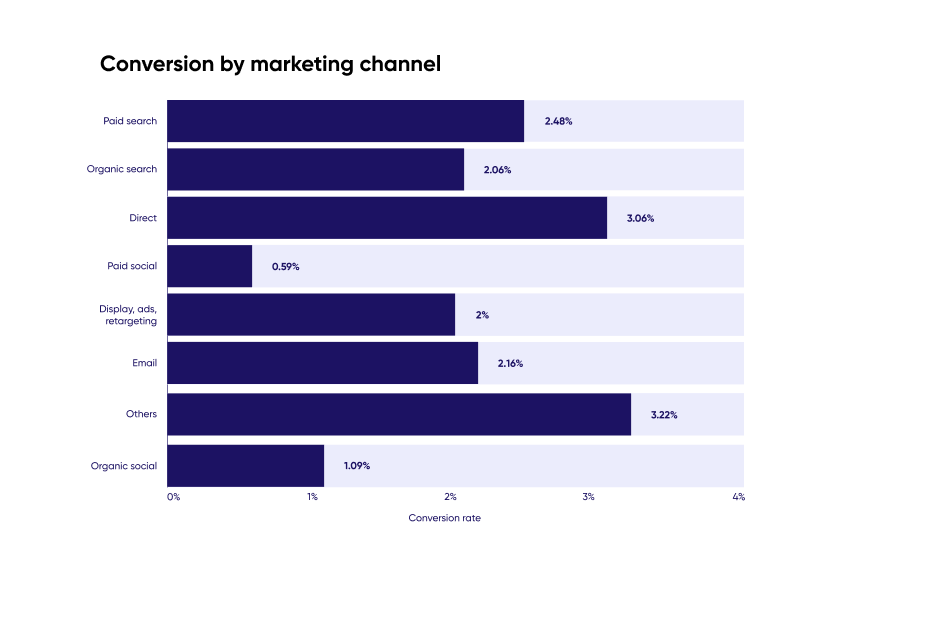

Despite the number of active users on social media in the world increasing by +7.1% YoY from 4.62 billion in 2022 to 4.95 billion in 2023—social still struggles to covert.

During peak season 2023, paid and organic social were the two of the lowest converting marketing channels—barely hitting a 1% conversion rate.

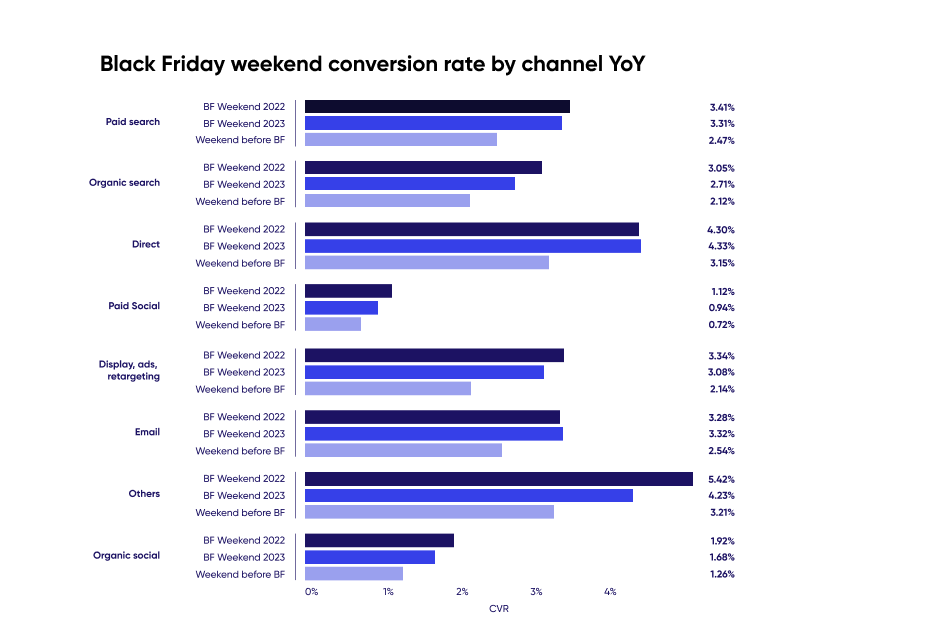

This trend was apparent during Black Friday weekend as well. Both paid and organic social saw a decrease in conversion rate YoY of over -20%.

On the flip side, paid search drove the highest conversions during Black Friday weekend 2023 at 3.89%. Running promotions on paid search during the long discount weekend has the potential to deliver over +50% higher conversion rates.

To ensure they stand out and make the most of every single click, retailers can benefit from adjusting and fine-tuning Google search ads.

Retailers saw bigger average order values (AOV) during Black Friday weekend in 2023, compared to 2022. AOV also increased on both mobile and desktop devices and by +7.7% YoY overall.

And not only does desktop convert more, but it also drives order values up. In 2023, desktop AOV was +40.2% higher than on mobile.

To encourage more customers to splurge more on smartphones, retailers can try providing recommendations of similar discount items and cross-category holiday promotions, particularly on mobile product detail pages (PDPs).

This makes it easy for users to make holiday purchases and find items on offer that might complement each other, increasing consumer spending on mobile.

But before making any changes, retailers must understand their unique visitor behavior across devices to optimize online shopping journeys and their omnichannel strategies accordingly.

One brand leading the way is Sykes Holiday Cottages. Find out how they’re using Contentsquare’s CS Apps analytics to enhance their mobile user here.

Peak season is arguably the busiest and most stressful time of the year for retailers.

So, before the big holiday season rush takes over, discover the most important digital KPIs and trends in our Retail Peak Season Digital Experience Benchmarks.

Then, dig into our peak season guide for the most crucial site optimization tips with UX examples from nine big brand retailers, including Harrods, AVON and Early Settler.

How to prepare for peak sale season A guide to seasonal site optimization with UX examples from 9 big brand retailers.